Things to think about before investing in property

Whether it’s your first property or you’re a real estate guru, consider the pros and cons and crunch the numbers before investing in property.

Your investment goals: After passive income through rent? Long-term capital growth? Consider how an investment property could fit into your investment plan or chat with a financial advisor.

Property research: Look at recent sales data or speak to local real estate agents to get an idea of property prices, rental yields, and vacancy rates.

Consider the costs: There are additional costs for an investment property including property management fees, agents fees, repairs, and other landlord costs. Chat with your accountant to understand what expenses you can claim or offset.

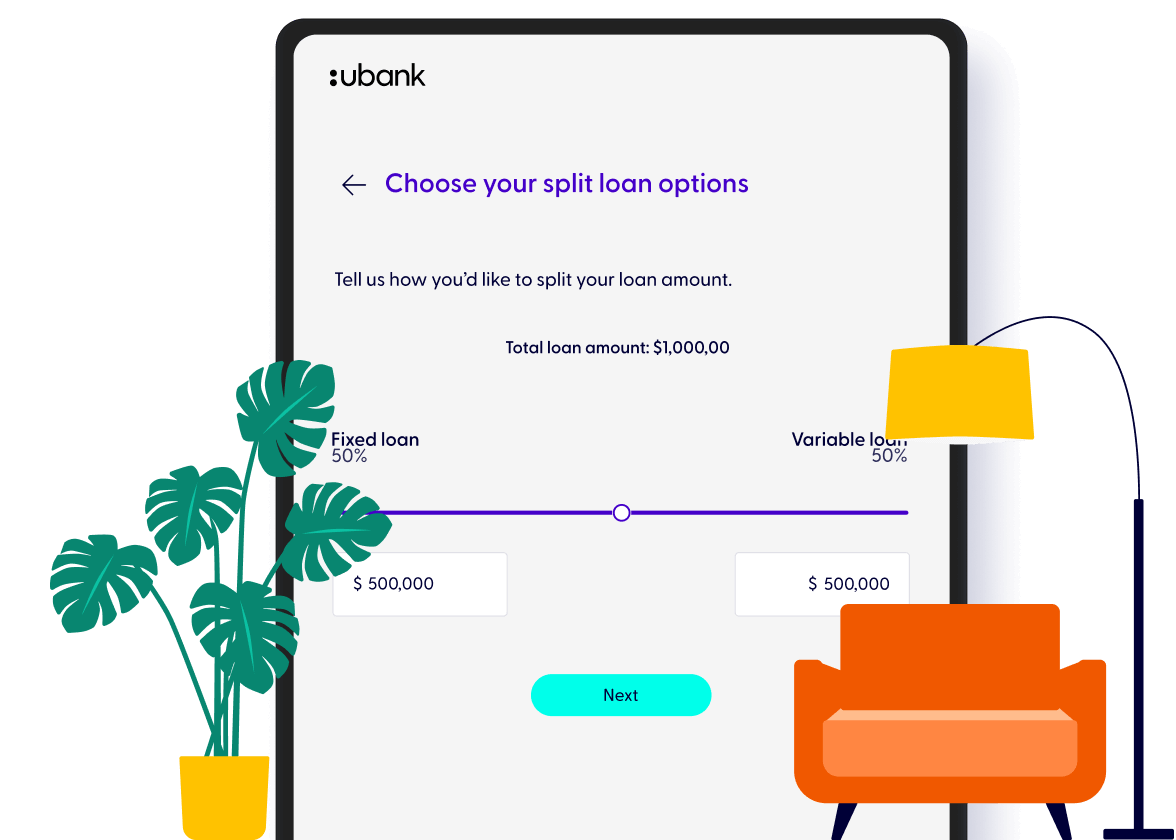

Calculate your borrowing power

How much can I borrow?

Let’s crunch the numbers. Just input your income and expenses, and our borrowing calculator will estimate how much you could borrow and what the repayments would be.

Home loan eligibility

Let’s see if we’re a good match

How to get an investment loan with us

Purchase or switch to a ubank home loan in 4 easy steps

1. See if we’re a good fit

Compare your loan and check if eligible for a ubank home loan

2. Apply online

Easy online application or talk with a lending specialist

3. Get a decision ASAP

If your application hits the mark, you’ll get an approval fast

4. Accept and relax

Review your loan docs online, accept your offer, all done!

FAQs

Have any questions?

Ready to chat about investing?

Talk it over with one of our lending specialists.

Monday to Friday 9am-7:30pm, Sat and Sun 9am-5:30pm (Syd time)

Tips and guides

A guide to investing

Explore our home loan products

Find out everything there is to know about our home loan offerings

Want the key facts?

We’ll give you the key facts you need to know about your preferred loan.