Why our Shared account

What's in it for you

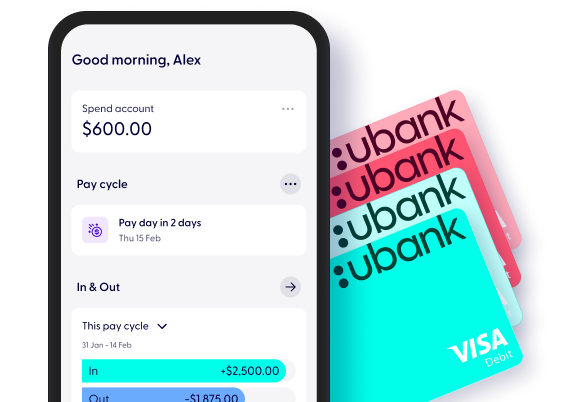

Multiple twin cards to keep track of what's what

Our Shared accounts have separate cards from individual accounts, so you can quickly tell which account you’re spending from.

Shared Spend accounts come with a sleek light aqua Visa Debit card and a darker aqua colour with clear labels for your individual Spend.

Shared Bills accounts come with a light coral Visa Debit card and individual Bills card in a darker coral so you can keep your bills separate.

When you open any Shared ubank account, you’ll still have your own Spend, Save, and Bills accounts. That way you can keep your personal daily expenses or those little indulgences private.

App experience

Explore how we're different

We’re not like the other banks. We’ll help you hit your shared targets, track upcoming expenses and give you the visibility you need.

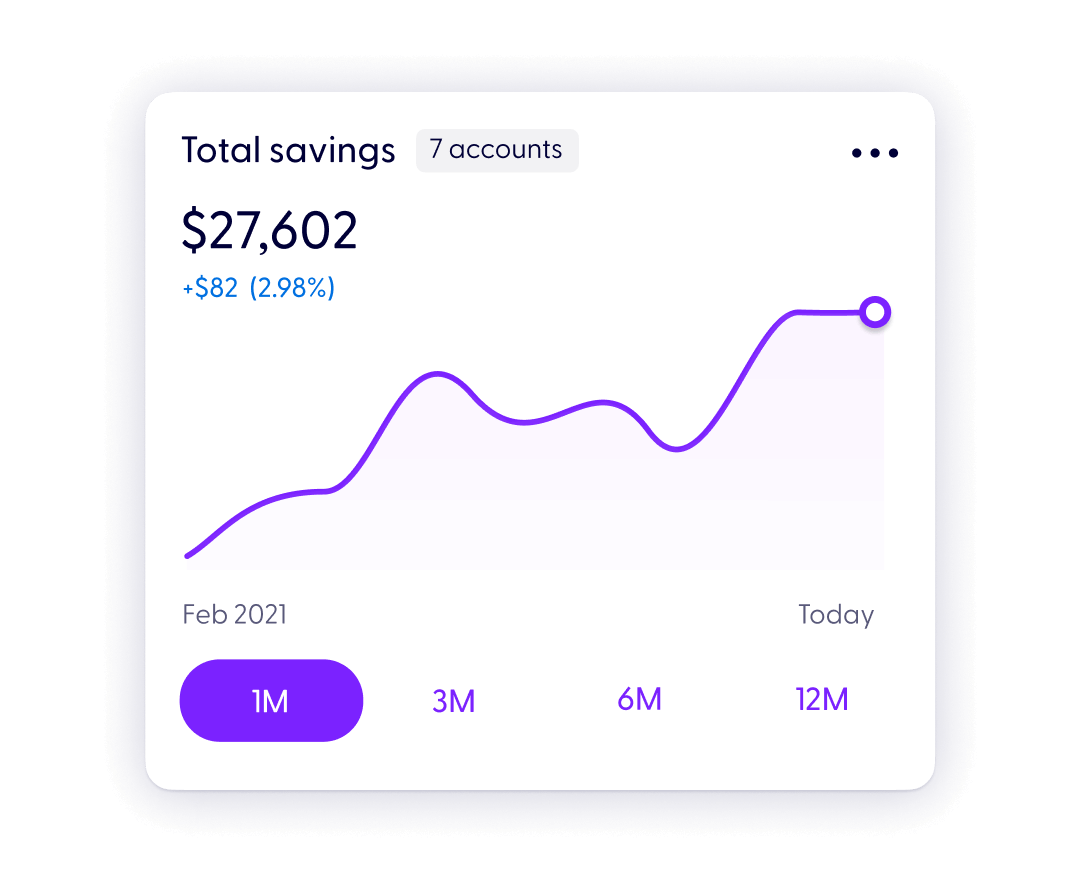

Watch your savings grow together

Hit your shared savings goals sooner with bonus interest on your Shared Save accounts. To get bonus interest for the month, you need to meet the bonus interest criteria.

You can get bonus interest across all your Save accounts on combined savings up to $1M per customer (including Shared accounts).

We calculate interest on your Save balance for each day and pay it monthly. Don’t miss out on meeting the criteria to earn bonus interest, otherwise interest won’t be payable.

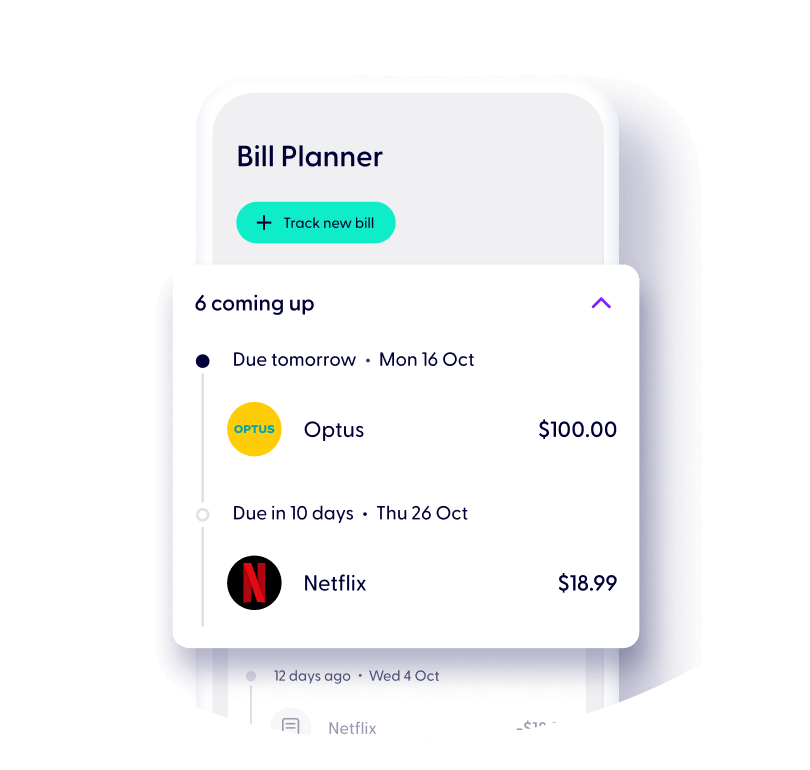

Split the bill with a Shared Bills account

Make bills more chill with a joint account to organise and pay for your shared expenses.

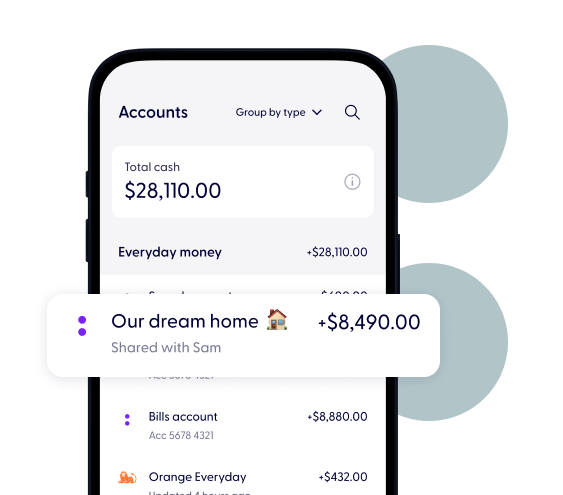

Like an individual Bills account, you’ll both get a digital only Visa Debit card to set up any regular payments and direct debits. Your shared accounts sit along with your other accounts so you can both easily check the balance.

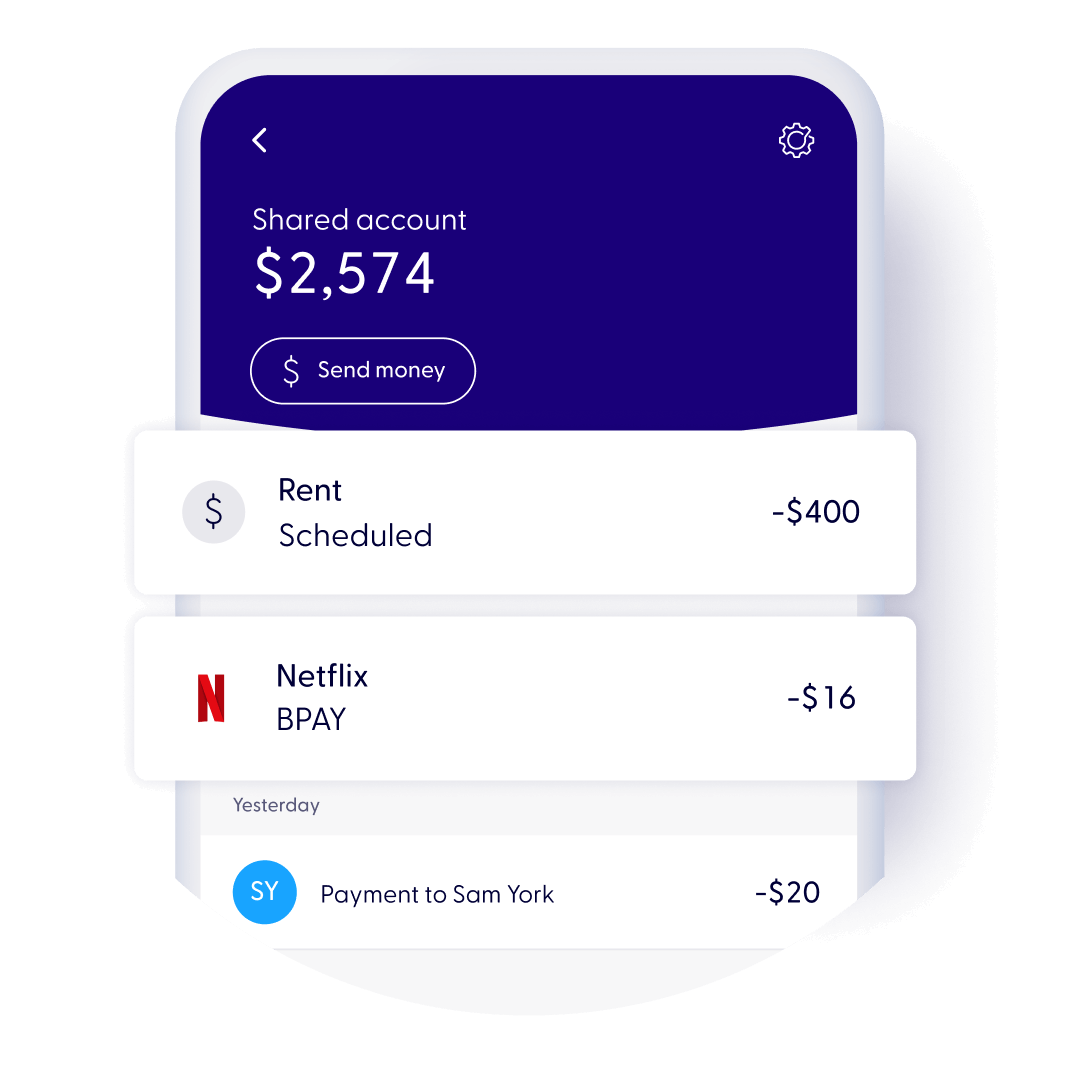

Schedule your payments from your Shared Bills for anything you share like rent, cat food, or child care. Separated from your other shared accounts, it will give you a clearer view of what’s coming out at a glance.

No more endless transfers

Tired of constantly paying each other back? With a Shared Spend account, you can have one account for all your day to day spending.

But don’t lose track of who got what. With each transaction, we can show you which card was used.

Start using your Shared account straight away

Starting your Shared account takes seconds. It’s as easy as sending an invite link to your partner-in-finance from your app.

Once it’s set up, you can use it straight away by transferring into your shared account via Osko and PayID.

You can even start spending instantly from your Shared Spend account by setting up Apple Pay or Google PayTM, no need to wait for the plastic to arrive.

Join us

How to open a Shared account

Get a Shared account in seconds once you have your individual accounts.

Join ubank and open a Shared account in 4 steps

Both of you will need to download the ubank app.

Verify your details to open your own individual Spend, Bills and Save accounts.

Open a Shared account in the app and invite your partner-in-finance.

Once they accept the invite, you can start enjoying your Shared account.

To join us, you’ll need to be over 16 years old and an Australian citizen or permanent resident.