Why a ubank account

What's in it for you

Our accounts

What makes our accounts different?

Get a Spend, Bills and Save account in just minutes and a Shared account in a couple of seconds.

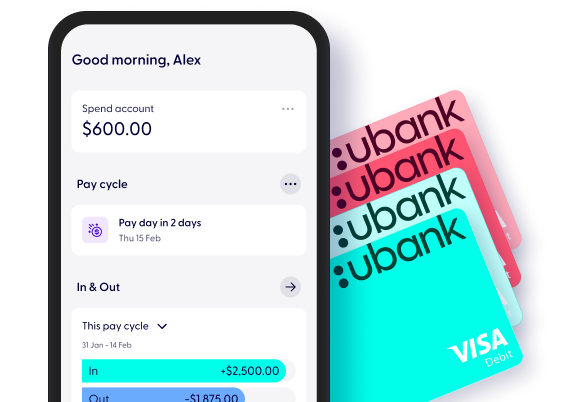

Spend account

Spending to feel good about

Say goodbye to monthly account fees with our Spend account, as well as international card payment charges.

Spend before your physical card even arrives by setting up Apple Pay or Google Pay™.

Transfer in and out of your Spend account immediately via PayID and Osko (if the other bank has it).

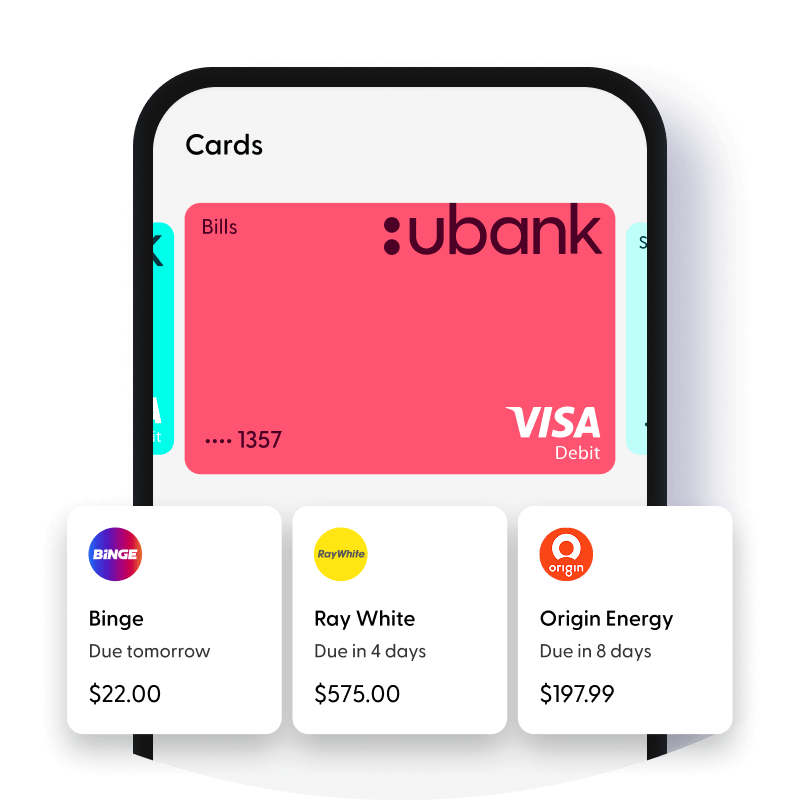

Bills account

Make bills more chill

Stash some cash to cover your bills and get a digital card to set up regular payments.

Start tracking with Bill Planner to see what bills are coming up and how much money you should put aside.

Can be used as an offset account on a ubank home loan.

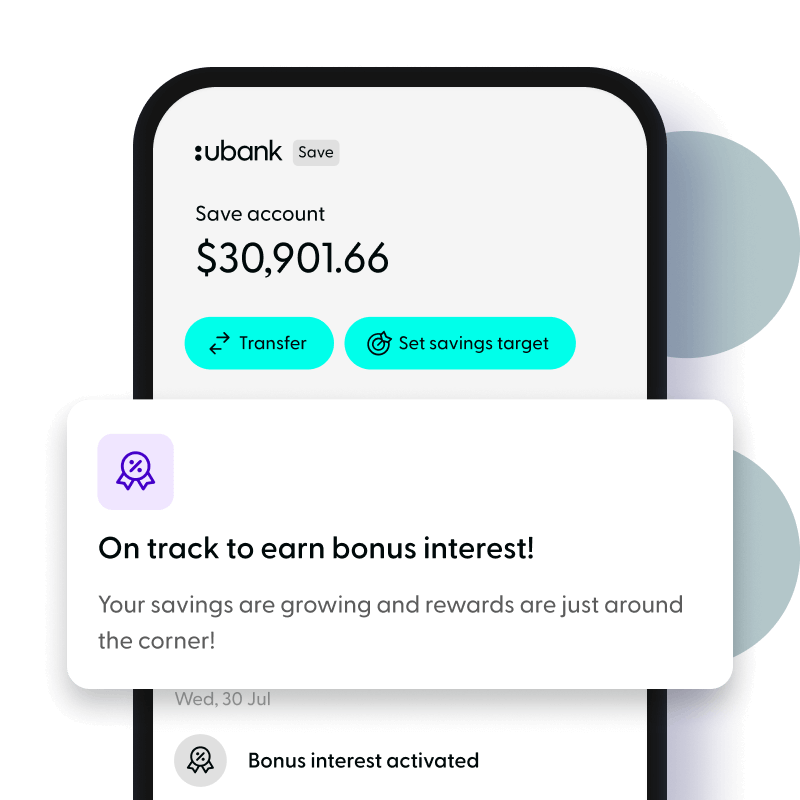

Save account

Become a more successful saver

Get bonus interest on combined savings up to $1M across all your Save accounts. Until 30 September 2025, all you need to do is have a Spend account and deposit $500+ per month into any Spend, Bills, or Save accounts (not including internal transfers) to get bonus interest. From 1 October 2025, our bonus interest criteria is changing, find out more here.

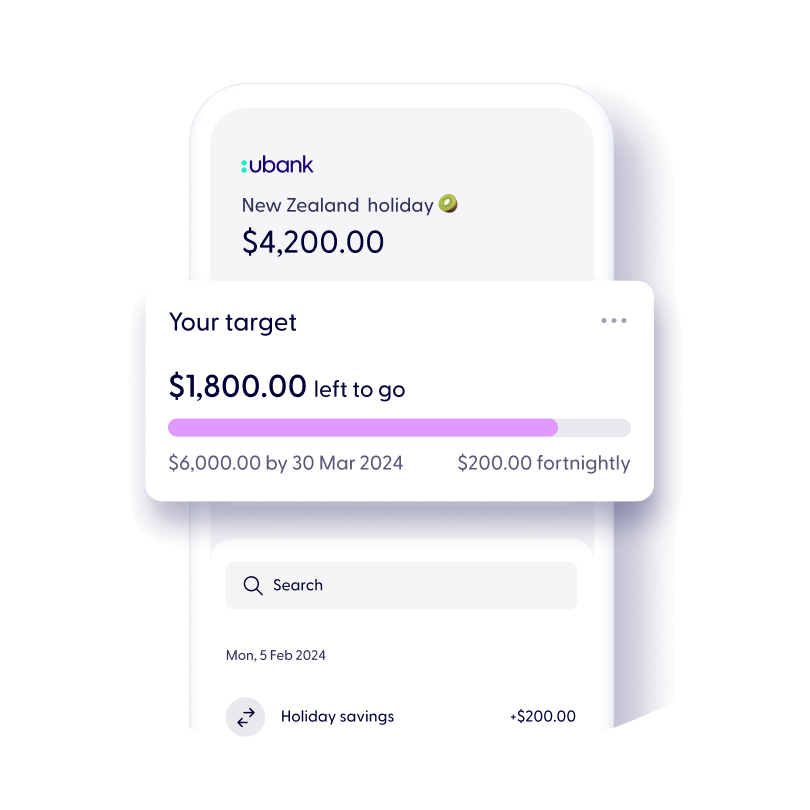

Set up savings targets for your Save accounts and automatic transfers to hit goals and save like a machine.

We’ll send friendly nudges to help you activate bonus interest each month.

Shared account

Mine. Yours. Ours.

Get separate cards for your individual Spend and Shared Spend accounts, with different colours and clear labels to distinguish between them.

Need a place to schedule joint expenses from? With a separate Shared Bills account, you’ll get a digital card to do just that.

You and your partner-in-finance can stop mucking around with pesky split bills and transfers.

Ways of banking

Choose how you bank

Our feature packed app

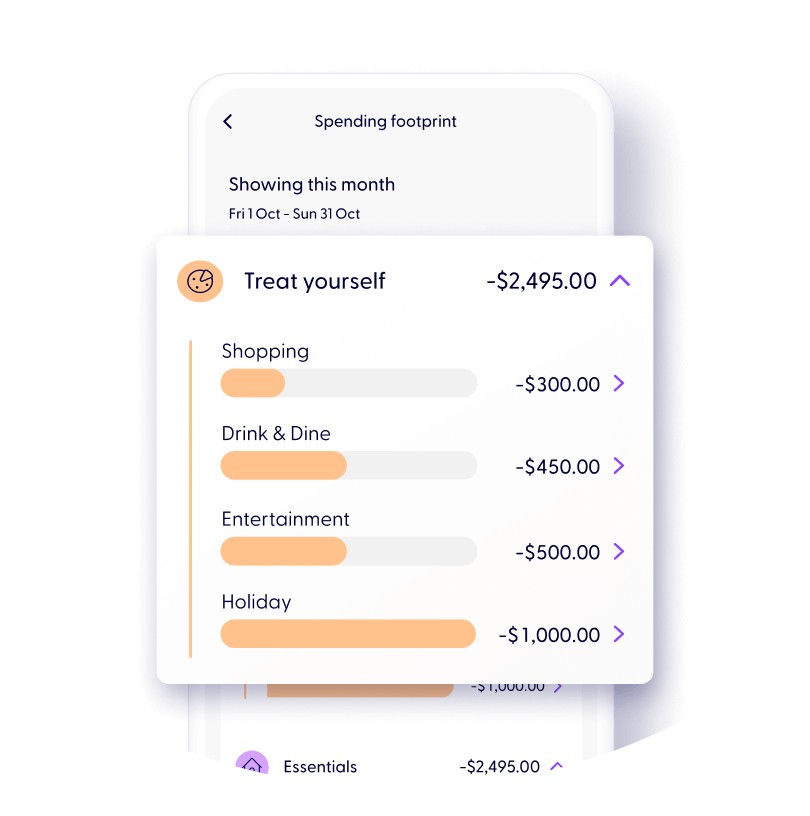

The app jammed with handy features to help you get ahead with money.

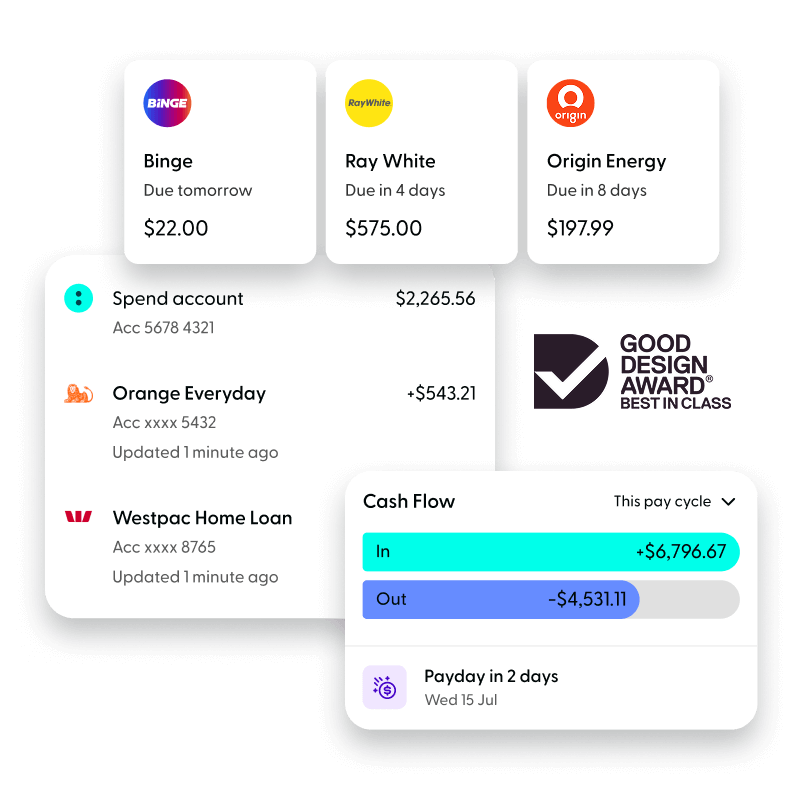

Connect your accounts from over 140 financial institutions and get a panoramic view of your finances.

Keep on top of what goes in and out of your account with our In & Out feature. Add your Pay Cycle to keep track pay to pay.

Spending Footprint automatically sorts your transactions to give you insights into your spending.

Start tracking your bills in the Bill Planner and see what you’ve got coming up by syncing with your Pay Cycle.

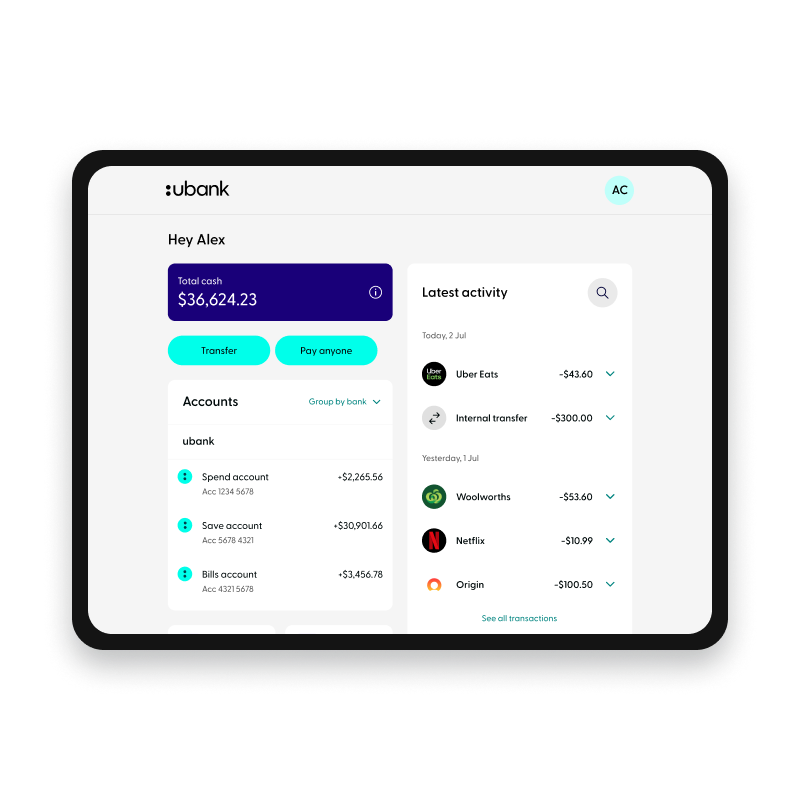

Our online banking

Try online banking for those of you who like to see it all on the big screen.

Make instant payments and transfers from your Spend account via PayID and Osko (if the other bank has it).

See your connected accounts just like you do in our app.

Have your spreadsheet open on one tab and your online banking on another for budgeting made easy.

Guides

Ways to max your money

FAQs

Got some questions?

Need help?

Chat with our team