Why our Spend account

What's in it for you

Start spending straightaway

Sign up and start spending with instant payment methods.

Get instant access to Apple Pay and Google Pay. We also have Samsung Pay and Garmin Pay.

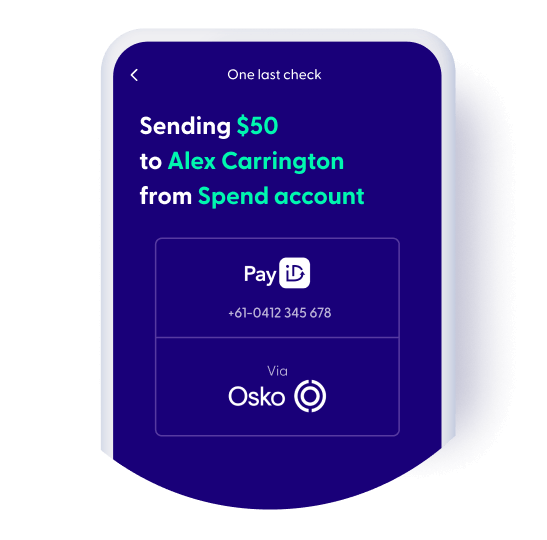

Transfer in and out of your Spend account almost instantly via PayID and Osko (if the other bank has it).

Get on top of recurring bills, subscriptions and memberships directly from your app using PayTo.

Rest easy knowing your bills are paid same day through BPAY – just transfer on a business day before 6pm (Sydney time).

Left your wallet at home? Securely access your full card details in the app wherever you are.

Rates and fees

Everyday banking without the fees

| Fees | Charges |

|---|---|

Set up and monthly fees | Free |

Payments using the ubank app | Free |

Using your card in Australia

Card purchases and ATM cash withdrawals | Free

Some merchants and ATM operators may charge a fee |

Using your card overseas or online

Card purchases and ATM cash withdrawals | Free

Some merchants and ATM operators may charge a fee |

Direct debit dishonours | Free |

Replacement card in Australia | Free |

Emergency Visa replacement card or cash | Free |

Why ubank

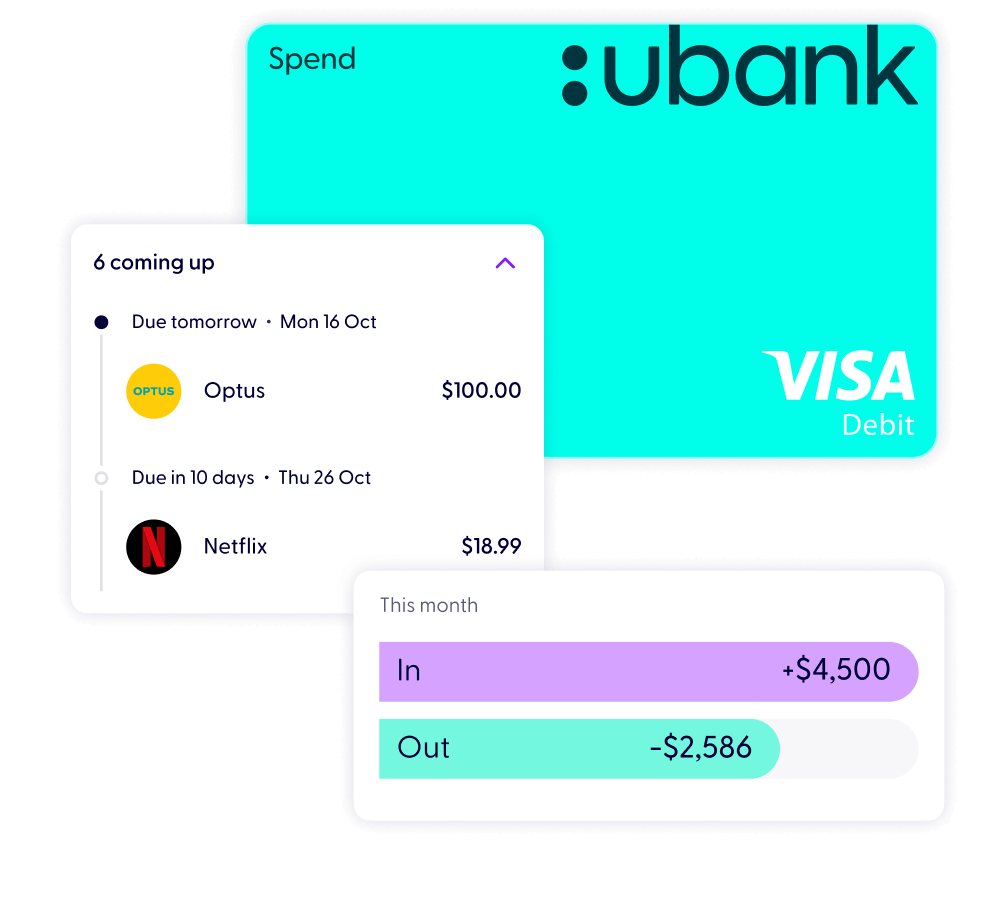

See your money clearly

Get better visibility with the Ubank app, so you can money better and reach your goals.

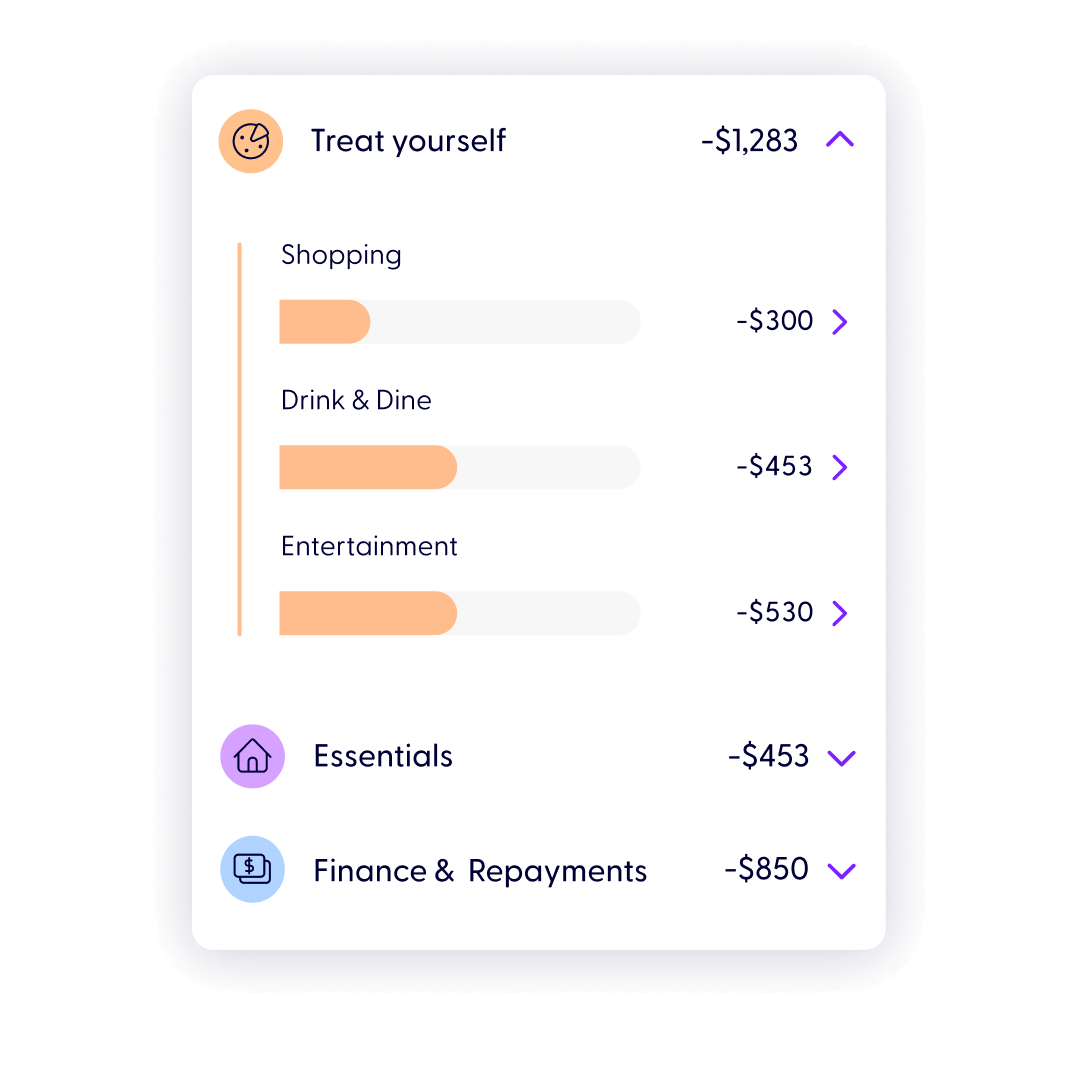

Spending Footprint helps you retrace your spend

Retrace your spending with Spending Footprint so you always know where your money is going.

We sort your transactions into common spending categories for you.

See how much you’re spending at your favourite stores, food spots, on bills, transport, etc.

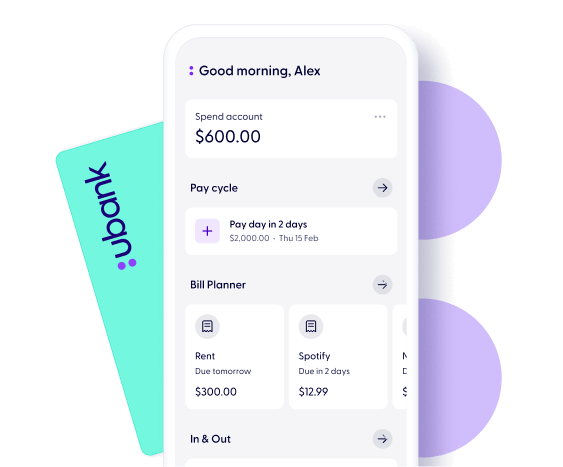

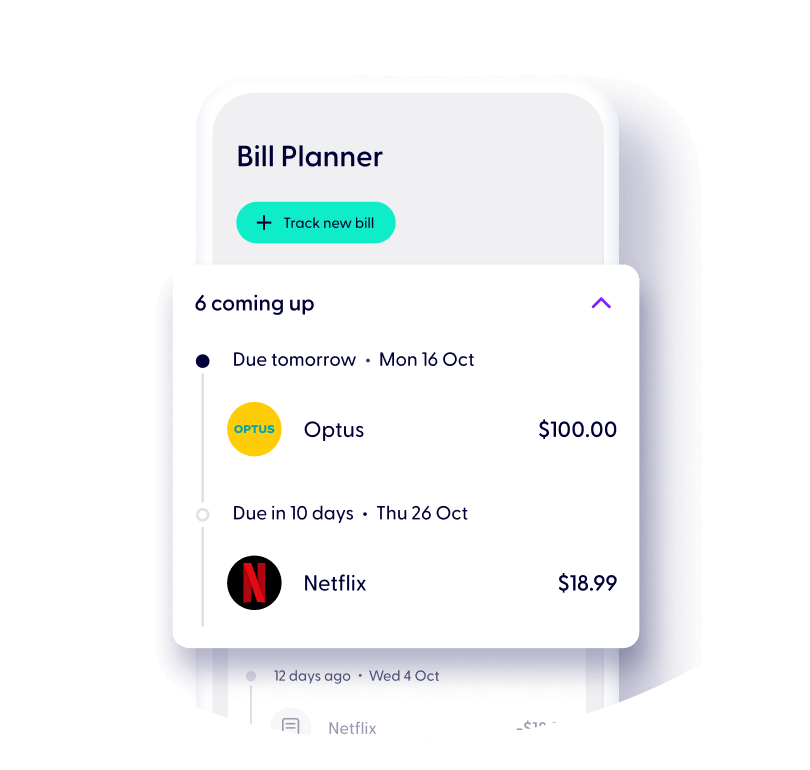

Plan for your expenses by tracking your bills in the Bill Planner

Start tracking your bills to see what you’ve got coming up.

See what’s coming up by syncing with your Pay Cycle

The magic of the Bill Planner will easily show what you’ve got coming up so you can budget and keep money for the good stuff.

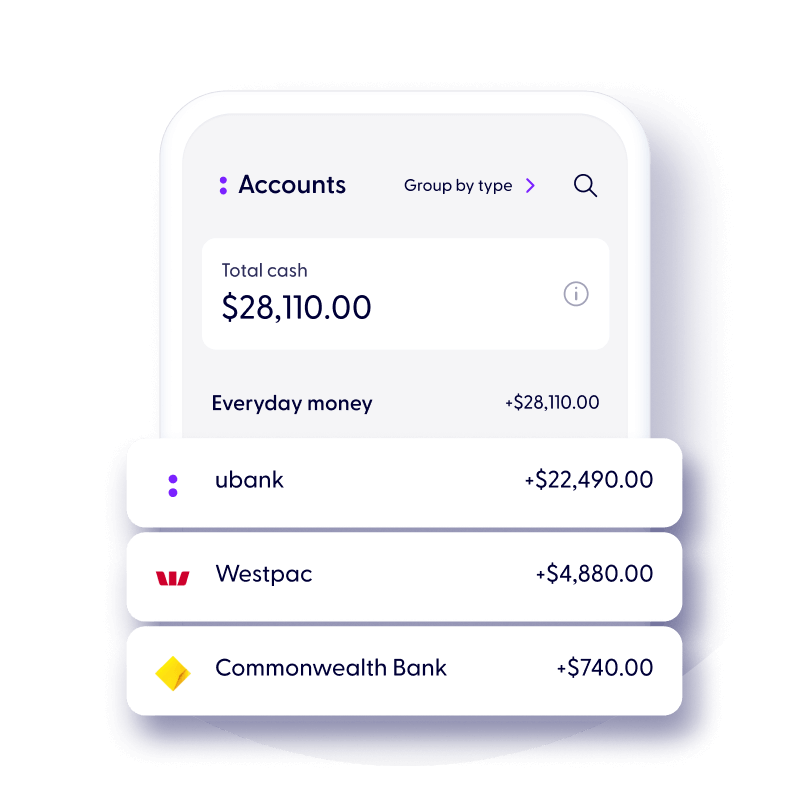

It’s okay to see other banks

Connect your accounts from over 140 other financial institutions, to see your money in one place. Think of us as your daily money companion.

You can even connect your super and investments to get the whole picture of how your money is moving.

Our Smart Search feature allows you to find transactions across your ubank and connected accounts in a simple search.

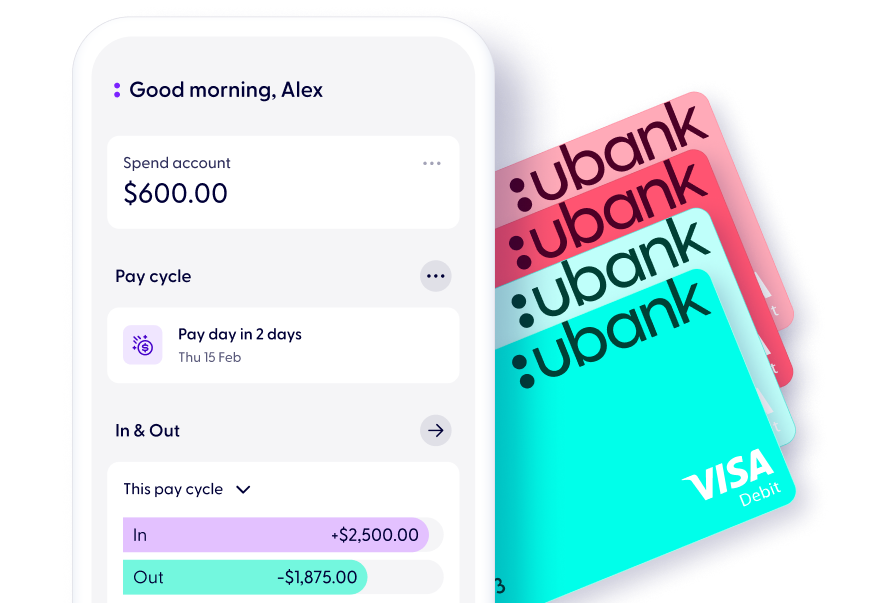

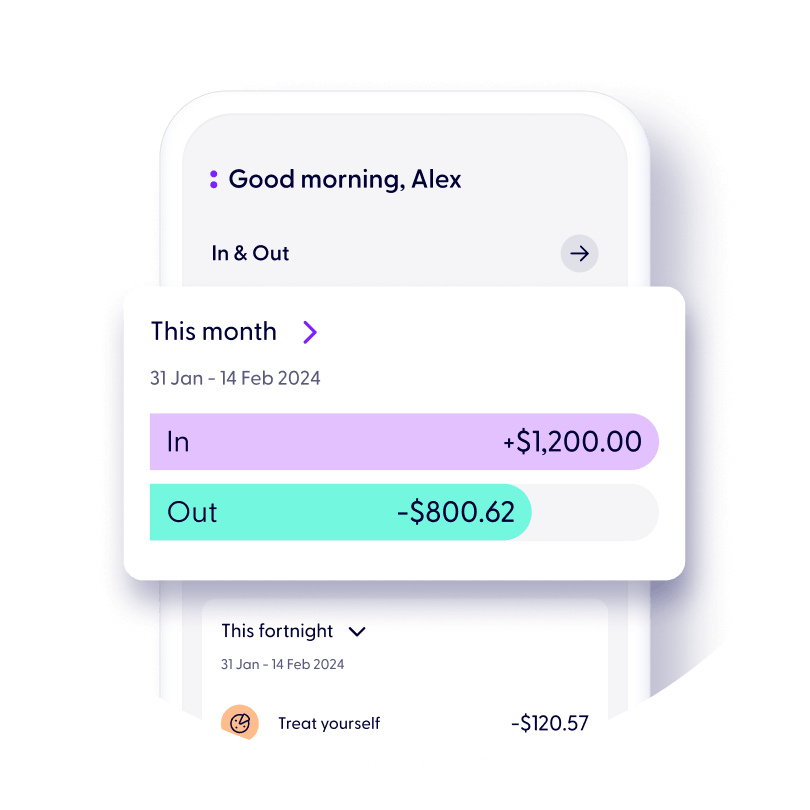

Know your money inside and out

Stay on top of what’s coming in and going out of your ubank accounts with our In & Out feature.

Strike the balance between spending and saving by setting a time period that lines up with your pay cycle.

Plus get 2 more accounts, a Save and a Bills

When you join ubank, you’ll get 3 accounts, a Spend, a Bills and a Save account. Save gives you great interest rates, instant access to your savings, both accounts have no fees.

Join us

How to get started with ubank

You can start using your Spend, Bills, and Save accounts in minutes

Download the app

Enter your ID and personal details

Start using your new accounts

To join us, you’ll need to be over 16 years old and an Australian citizen or permanent resident.