Why our Save account

What's in it for you

Our high interest savings rate

What makes up our total interest rate

Your combined savings balance (of all your Save accounts) will fall into different tiers with a corresponding bonus interest rate. The tiers mean that different amounts of your savings will earn different rates depending on which tier they’re in if you meet the bonus criteria.

| Tiers | Bonus rate (p.a.) |

|---|---|

$0 up to $100K | 5.10% |

Over $100K up to $250K | 4.65% |

Over $250K | 0.00% |

Rates are variable and subject to change. Interest is calculated on your combined savings balance daily and paid monthly. No interest is payable if the bonus criteria are not met. See what makes you eligible for bonus interest.

How it works

Understanding bonus interest tiers

| If you had a combined savings of $50,000 | If you had a combined savings of $100,000 | If you had a combined savings of $150,000 | If you had a combined savings of $200,000 | If you had a combined savings of $250,000 | |

|---|---|---|---|---|---|

$0 up to $100K 5.10% p.a. | $50,000 | $100,000 | $100,000 | $100,000 | $100,000 |

Over $100K up to $250K 4.65% p.a. | $50,000 | $100,000 | $150,000 | ||

Your effective rate is | 5.10% p.a. | 5.10% p.a. | 4.95% p.a. | 4.88% p.a. | 4.83% p.a. |

Disclaimer: When calculating the effective rate we have assumed 31 days in the month, 365 days in the year, and daily balances have remained exact throughout the 31 days. We have assumed you have met the bonus interest criteria.

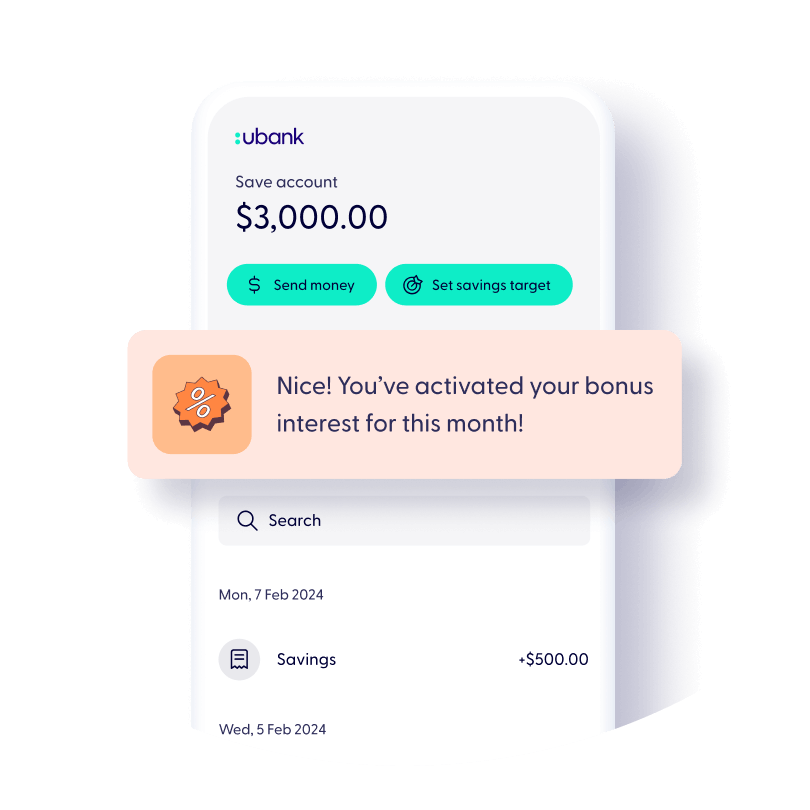

Want bonus interest on all your Save accounts?

All you need to do is have a Spend account and deposit $500+ per month into any Spend, Bills, or Save accounts (not including internal transfers) to get the bonus interest rate. Easy.

Take money out at any time without affecting your bonus rate.

Open up to 10 Save accounts and get bonus interest on all of them, including shared Save accounts.

Get bonus interest on combined savings of up to $250K across all your Save accounts. Your savings up to $100K will earn 5.10% p.a. and over $100K to $250K will earn 4.65% p.a.

Don’t miss out on bonus interest with the help of our friendly nudges.

Why ubank

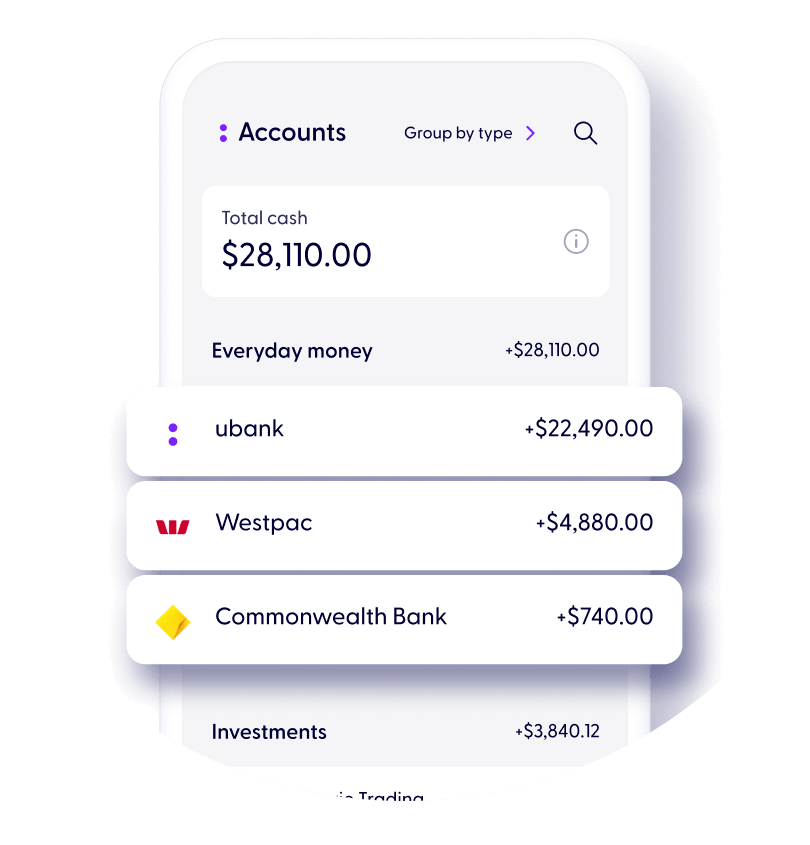

See your money clearly

Get better visibility with the Ubank app, so you can money better and reach your goals.

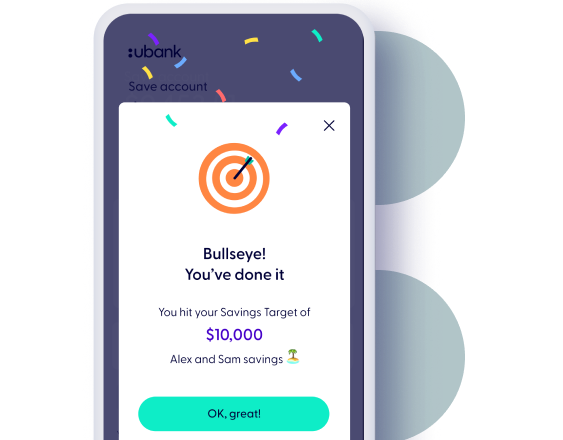

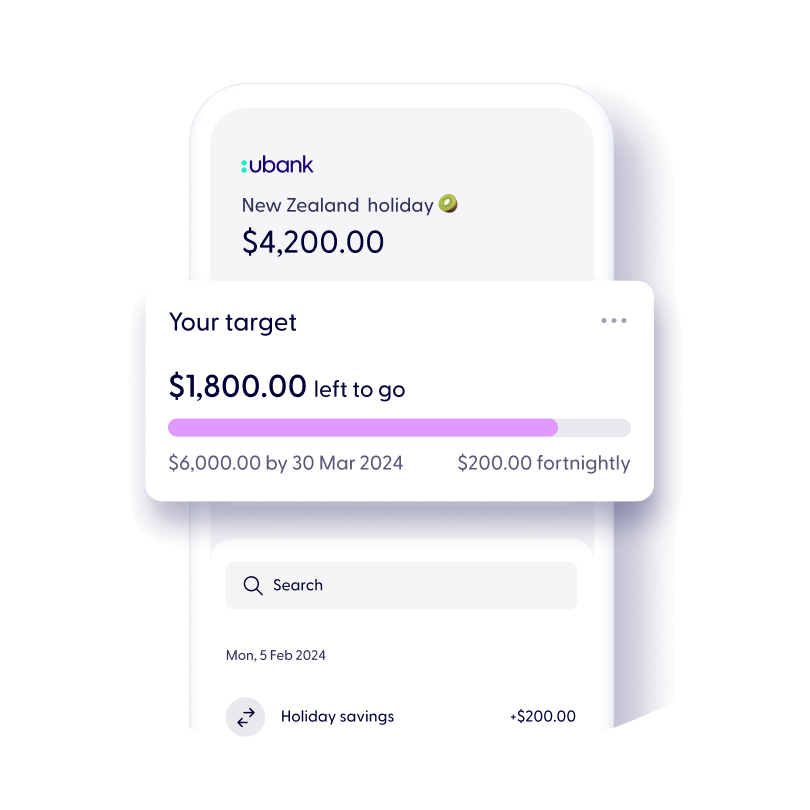

Hit all your savings targets, right on the money

Create up to 10 Save accounts and set targets on any of them.

We’ll help you smash your goals. Tell us when you want to hit your target and we can show you how to get there one step at a time.

Edit your target at any time and we’ll adjust your plan to get there.

Almost instant access to your savings when you need it

Transfers in to your Save account are almost instant via PayID and Osko (if the other bank has it).

Life happens, so you can take money out at any time without affecting your bonus interest rate – it’s your money after all!

It’s okay to see other banks

See your money in one place by connecting to over 140 other financial institutions.

You can even connect your super and investments to get the whole picture of how your money is moving.

With an easy savings graph, you can see your total savings across all your connected accounts.

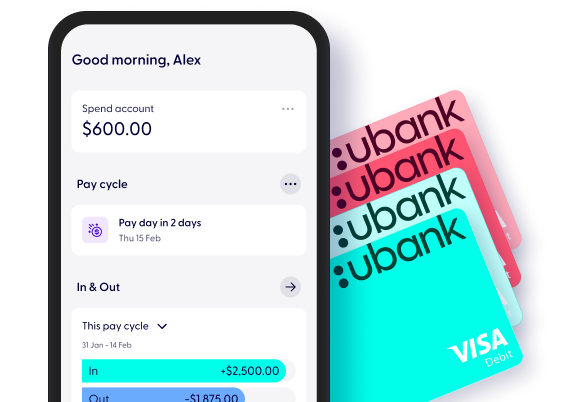

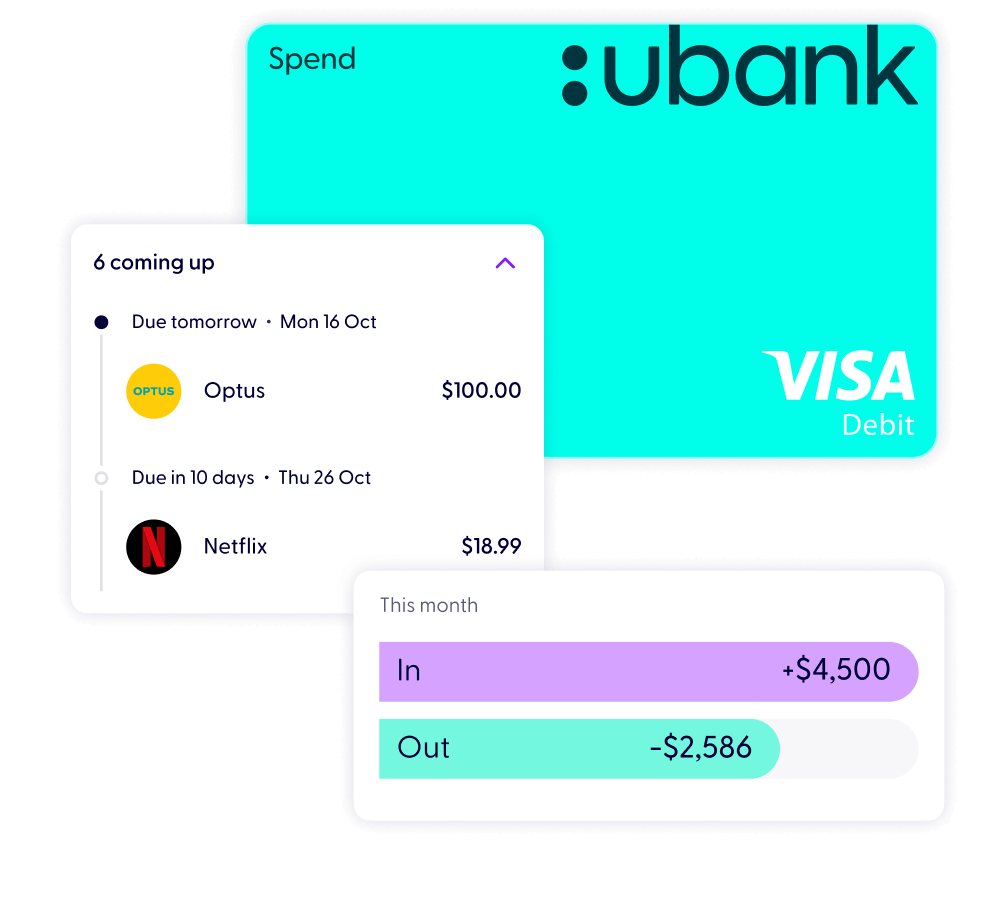

Plus get 2 more accounts, a Spend and a Bills

When you join ubank, you’ll get 3 accounts, a Spend, a Bills, and a Save. Our accounts come with handy features to manage your money and have no everyday fees.

Join us

How to get started with ubank

You can start using your Spend, Bills, and Save accounts in minutes

Download the app

Enter your ID and personal details

Start using your new accounts

To join us, you’ll need to be over 16 years old and an Australian citizen or permanent resident.