Ubank rebuilds broker platform from the ground up

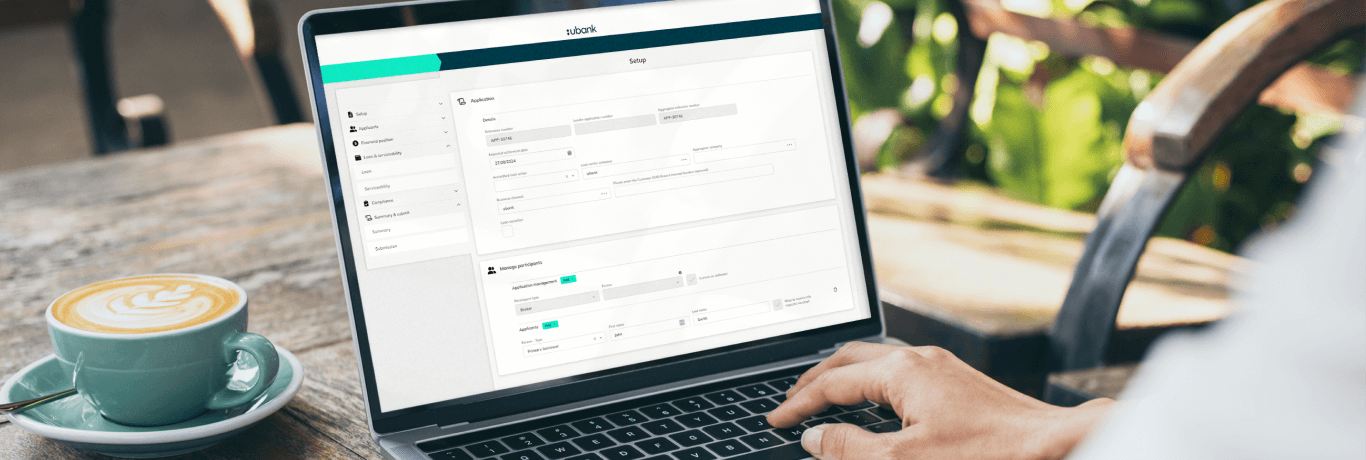

Australia’s award-winning digital bank, Ubank, has rebuilt its mortgage broker platform to streamline the digital home loan lodgement process and deliver a compelling online experience for brokers and their customers.

More than technology, the new broker platform is the cornerstone of Ubank’s broker strategy to create shared success in the rapidly evolving mortgage broking industry by providing them with powerful tools, underpinned by a bespoke end-to-end-process.

George Srbinovski, Ubank’s Head of Broker Distribution, said: “In recognition of the increasingly important role mortgage brokers play in the Australian home lending market, Ubank has listened to feedback and rebuilt its online broker platform from the ground up.

“With the majority of Australians (7 out of 10) choosing to purchase a home or investment property via a broker, our goal was to develop a platform that helps brokers work smarter. We have achieved this by working with brokers to address pain points in the lodgement process,” he said.

Ubank’s new platform is focused on speed, visibility and flexibility to improve the lodgement experience across the broker value chain, from application through to decisioning and fulfillment.

“Our new platform offers a more flexible and faster way for brokers to lodge. Brokers can access the platform securely to access integrated information requests and live status updates so they can keep track of their customer’s applications. Coupled with our competitive rates and swift approval times, Ubank can provide Australian brokers a compelling package that delivers to their business needs and the expectations of property purchasers in a market that values speed of response,” he said.

Technology under the hood

Ubank’s new digital broker platform has an improved user interface that allows brokers to complete home loan applications in any order.

The platform also equips brokers with an impressive range of intuitive tools and improved processes that reduce typical friction points within the home loan application process.

In an industry first, the platform’s Broker Flow tool eliminates repetitive data verification tasks by allowing brokers to use Illion BankStatements technology to collect customer data. The customer pre-submission process has also been streamlined with a single email touchpoint within the platform for customer tasks.

Additionally, the platform helps brokers to verify customer income via Smart Statements, reducing the paperwork required to lodge a home loan application by quickly and securely retrieving client income from their bank.

Ubank’s VOI (Verification of Identity) and privacy consent process has been significantly streamlined for customers and brokers alike. Customers now only receive one communication to complete their compliance tasks, allowing brokers to work simultaneously to complete the remaining pieces of the application.

Ubank has built automation and back-end smarts into its application review process through its Decisioning Engine – a tool the bank uses to better understand its customers and deliver faster credit decisions.

“Our Decisioning Engine allows us to review and approve most of our loan applications within two days. This means we can fast-track the ‘time to yes’ so busy brokers can feel confident about lodging deals with Ubank,” Mr Srbinovski said.

Committed to supporting brokers

The investment in our new broker platform underscores Ubank’s commitment to empowering the broker community with cutting-edge technology that helps them work smarter in an increasingly competitive market. Ubank is helping customers by providing the simplest process no matter which channel they come through, whether it’s proprietary or broker.

“Our technology investment in rebuilding our broker platform, coupled with our great home loan products and exemplary BDM service offering, demonstrates that Ubank is not just a financial partner but a true advocate for broker success. We’re dedicated to supporting the entire broker ecosystem so they remain competitive and well-equipped for the future,” Mr Srbinovski said.

—

Media contacts

Jacqueline Dearle, Senior Manager, Ubank Communications

Jacqueline.dearle@ubank.com.au

About Ubank

Ubank is a multi-award winning digital bank on a mission to make daily money success achievable for anyone. We believe the way to get there is to give our customers better visibility of their finances, so that they can make more informed choices and build a more positive relationship with money. Ubank helps people to see the possibility in their money and gives them the tools to reach their goals. Expressed simply, our philosophy is that when you can see money better, you do money better.