Why ubank

See your money clearly

Get better visibility with the Ubank app, so you can money better and reach your goals.

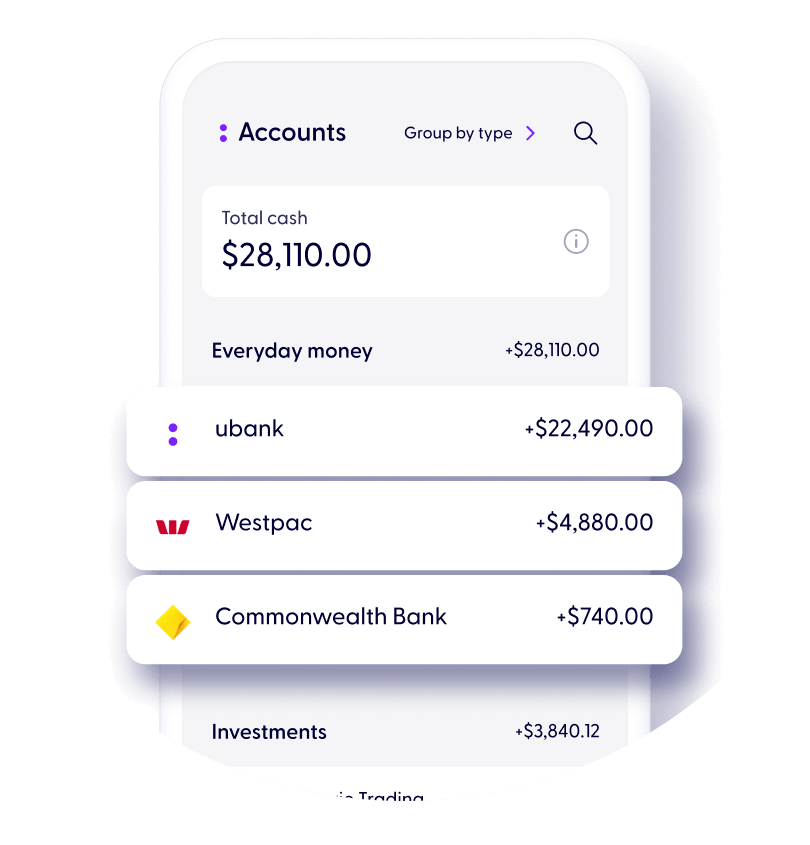

It’s okay to see other banks

Connect your accounts from over 140 other financial institutions, to see your money in one place.

With Smart Search to easily find transactions across ubank and connected accounts

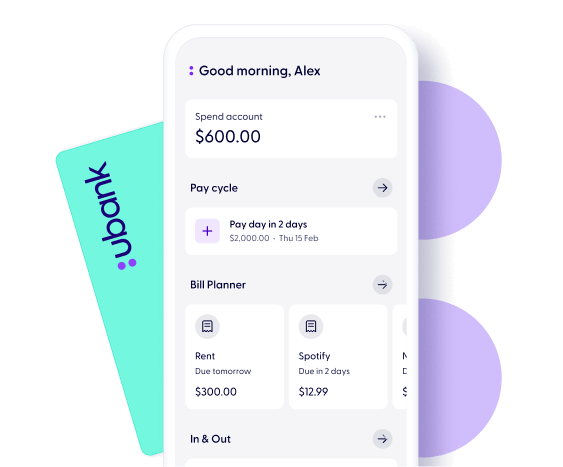

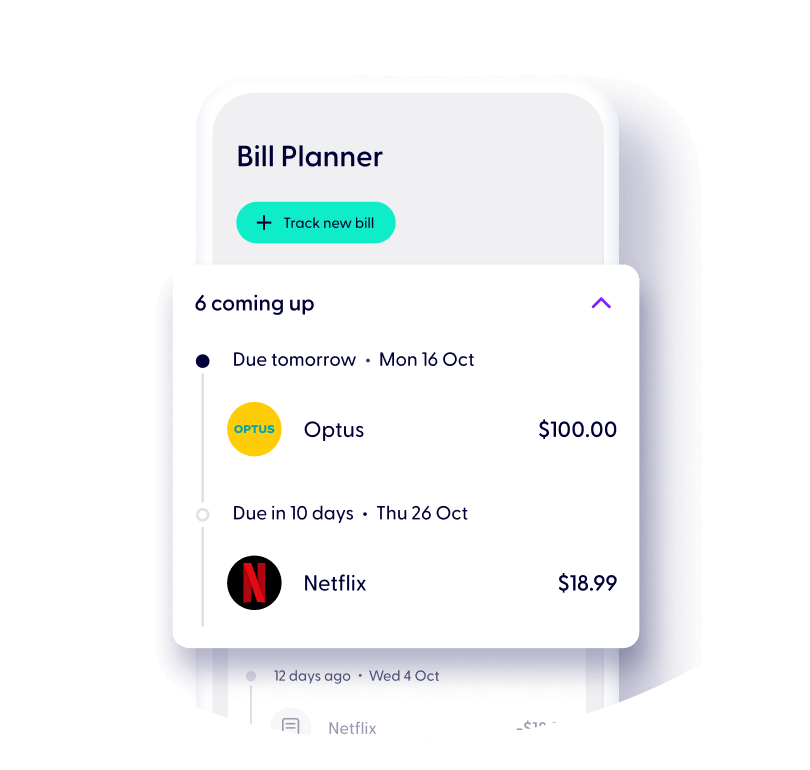

Plan for your expenses by tracking your bills in the Bill Planner

Start tracking your bills to see what you’ve got coming up.

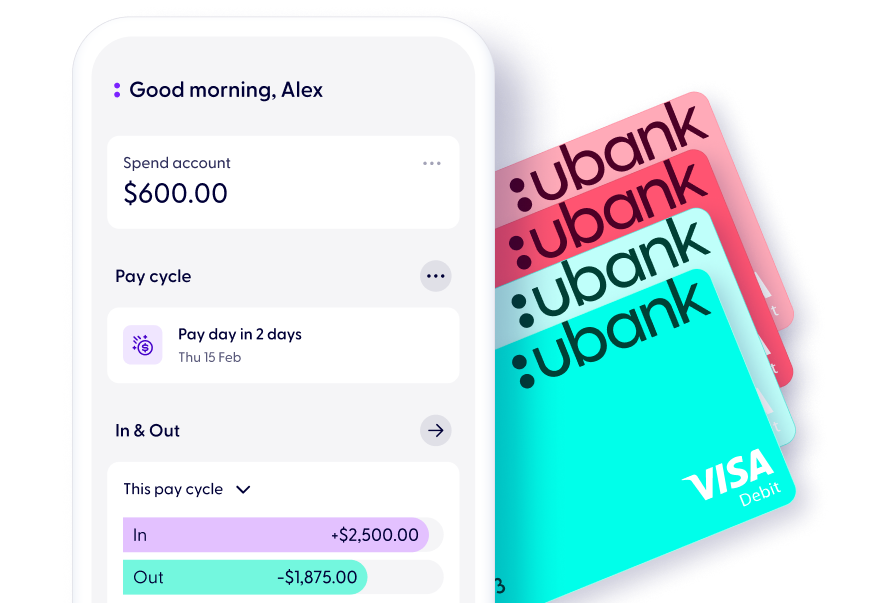

See what’s coming up by syncing with your Pay Cycle

The magic of the Bill Planner will easily show what you’ve got coming up so you can budget and keep money for the good stuff.

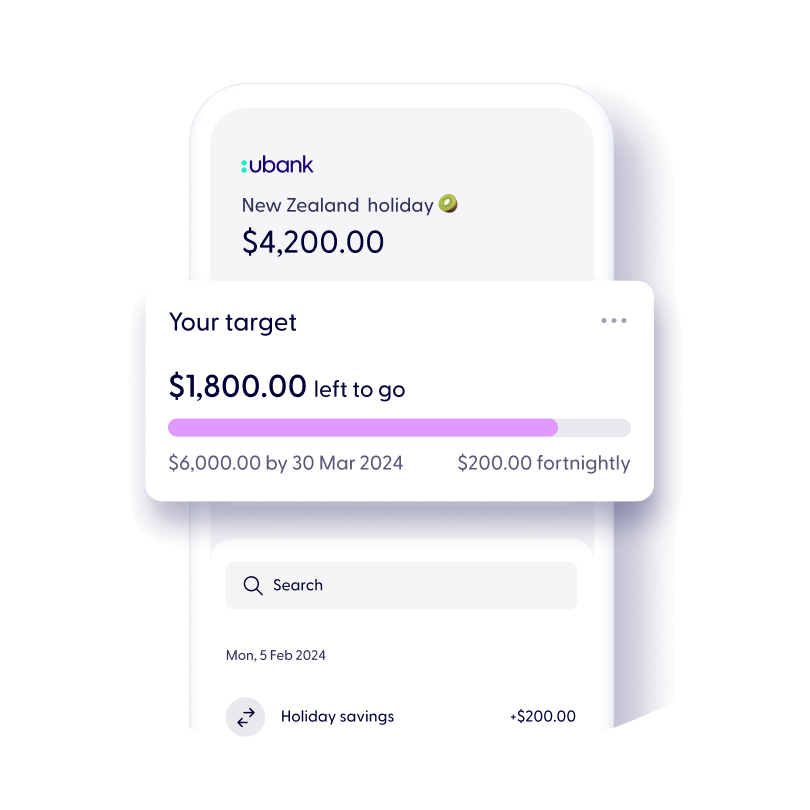

Hit all your savings targets, right on the money

We’ll help you smash your goals. Tell us when you want to hit your target and we can show you how to get there one step at a time.

Edit your target at any time and we’ll adjust your plan to get there.

Join us

How to get started with ubank

Start using your Spend, Bills, and Save accounts in minutes.

1. Download our app

You can download the ubank app on the App Store or Google Play™

2. Enter your code

After you create your login, enter your valid offer code

3. Get rewarded

Score $20 after you make 5 eligible card purchases in your first 30 days

To join us, you’ll need to be over 16 years old and an Australian citizen or permanent resident.

Bonus interest rates

Introducing our bonus interest rates

Your combined savings balance (of all your Save accounts) will fall into different tiers with a corresponding bonus interest rate. The tiers mean that different amounts of your savings will earn different rates depending on which tier they’re in if you meet the bonus criteria.

| Tiers | Bonus rate (p.a.) |

|---|---|

$0 up to $100K | 5.10% |

Over $100K up to $250K | 4.65% |

Rates are variable and subject to change. Interest is calculated on your combined savings balance daily and paid monthly. No interest is payable if the bonus criteria are not met, or on combined savings over $250K. Check out our FAQs to see what makes you eligible for bonus interest.

How it works

Understanding bonus interest tiers

| If you had a combined savings of $50,000 | If you had a combined savings of $100,000 | If you had a combined savings of $150,000 | If you had a combined savings of $200,000 | If you had a combined savings of $250,000 | |

|---|---|---|---|---|---|

$0 up to $100K 5.10% p.a. | $50,000 | $100,000 | $100,000 | $100,000 | $100,000 |

Over $100K up to $250K 4.65% p.a. | $50,000 | $100,000 | $150,000 | ||

Your effective rate is | 5.10% p.a. | 5.10% p.a. | 4.95% p.a. | 4.88% p.a. | 4.83% p.a. |

Disclaimer: When calculating the effective rate we have assumed 31 days in the month, 365 days in the year, and daily balances have remained exact throughout the 31 days. We have assumed you have met the bonus interest criteria.

We’ll help you stay on top of your money